Aircraft Leasing Companies - Technavio has released a new report on the global aircraft leasing market 2017-2021. (Graphic: Business Wire)

LONDON--( BUSINESS WIRE )-- Technavio has named the top five vendors in its latest report on the commercial aircraft leasing market. This research report also lists five prominent vendors that are expected to influence the market during the forecast period.

Aircraft Leasing Companies

The global commercial aircraft leasing market is driven by many factors. One of these factors is the increase in global passenger traffic, which is forcing airlines worldwide to increase the size of their existing fleets. This factor has also increased the importance of aircraft leasing contracts. Growing investments by Chinese and Irish aircraft leasing companies will also boost the global aircraft leasing market during the forecast period.

Leasing Group Aercap Loses Bid To Recover Aeroflot Jet

The global commercial aircraft leasing market has many regional and multinational vendors and the market is characterized by intense competition. However, large vendors such as GECAS and AerCap dominate the market. During the forecast period, the demand for improved response time is expected to increase long-term cooperation between airlines and air charterers.

"Vendors with financial muscle are expected to win key contracts in developing countries including India, China and Brazil. Low interest rates and value-added services will help them maintain long-term partnerships with airlines," said Avimanyu. Basu, chief aerospace analyst at Technavio.

The growth of major vendors is due to various factors, including the state of the direct aircraft purchase market, government initiatives and focus on the availability of leasing services worldwide. Retailers must expand their services to untapped international markets while reviving domestic demand to achieve sustainable growth.

Technavio's sample report is free and includes multiple report sections including market size and forecast, drivers, challenges, trends and more.

China Up For Sale

As of December 2015, AerCap had total assets of $43.89 billion and operated 1,109 aircraft. The company serves more than 200 customers in 80 countries. Airbus A320ceo and neo, Airbus A330 and A350 and Boeing 737NG and 787 make up more than 83% of the company's aircraft fleet. In fiscal 2015, the company completed 276 contracts and purchased 46 new aircraft. It currently has an order book of 439 aircraft from various airlines around the world.

BBAM engages in a range of aircraft leasing activities, such as arranging buy-to-let transactions for OEMs, sale-leaseback transactions for airlines and purchases of commercial aircraft from other lessors and financial institutions. The company provides services to more than 200 airlines in 50 countries.

CIT Commercial Air serves global and regional airlines primarily through its offices in the United States and other countries in Europe and Asia. As of December 31, 2015, the company financed, leased and operated a portfolio of 386 aircraft fleet.

.jpg)

As of December 2015, GECAS has leased 1,620 aircraft to various airlines worldwide and has ordered 423 aircraft for purchase. In September 2016, the company began taking delivery of the Airbus A320neo under an operating lease agreement.

Commercial Aircraft Leasing

As of March 31, 2016, SMBC Aviation Capital owned, operated and leased 660 aircraft to more than 100 customers in 43 countries. It also awarded Boeing an $8.5 billion order for 80 B737 Max 8 aircraft for delivery between 2018-2022. Thus, in 2015, the company signed an agreement with Airbus to supply 110 A320neo and five A320ceo aircraft worth $11.8 billion. These aircraft are scheduled to be delivered in 2017-2022.

Become a member of Technavio Insights and get access to these three reports at a fraction of their original cost. As a member of Technavio Insights, you get immediate access to new reports as they are published in addition to the 6,000+ existing reports covering the defense, homeland security and space sectors. This subscription will help you make smarter business decisions while connecting you to Technavio's ever-changing research library.

Technavio is a leading global research and consulting firm. The company produces more than 2,000 studies per year, covering more than 500 technologies in 80 countries. Technavio has approximately 300 analysts worldwide who specialize in customized consulting and business research on leading technologies.

Technavio analysts use primary and secondary research methods to determine vendor size and landscape in several markets. Analysts obtain information using internal market modeling tools and proprietary databases, as well as using a combination of bottom-up and top-down approaches. They corroborate this information with information received from various market participants and stakeholders in the value chain, including retailers, service providers, distributors, retailers and end users.

Five Aircraft Leasing Companies Based In Ireland Take Spicejet To Court

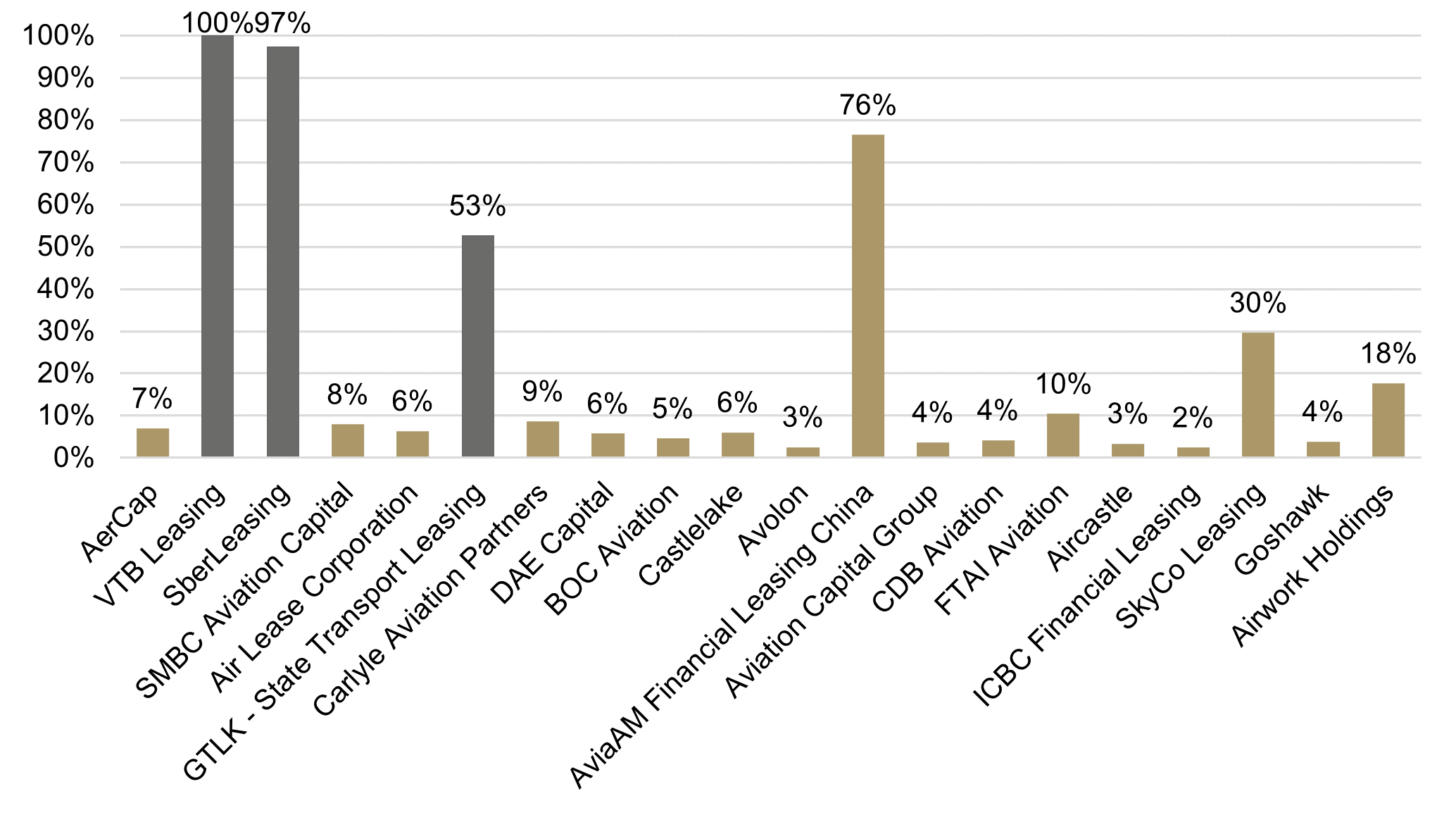

Technavio has named the top five vendors in its latest report on the global commercial aircraft leasing market 2017-2021. Gecas and AerCap dominate the aircraft leasing business by fleet size, each with a portfolio of more than 1,000 aircraft. (Source: Statista)

The $30 billion merger of aircraft leasing giants Gecas and AerCap, and the prospect of further consolidation of lessors in the wake of Covid-19, doesn't seem to be a concern for airlines and aircraft manufacturers, at least not publicly.

"My first observation about leaseholders is that they have remained very strong over the last year," Airbus CEO Guillaume Fourie told analysts on the company's first-quarter earnings conference call. "They have allowed this industry to thrive in very difficult circumstances. It depends on the stability of the financial system. There is no financial crisis and that is very important for us." Fourie acknowledged that Airbus considers consolidation of some tenants important. "There are positives and negatives to this situation. But in general, I can say that we are fine with it," he emphasized.

Willie Walsh, CEO of the International Air Transport Association, also dismissed concerns about the potential risk of excessive consolidation and anti-competitive behavior in the leasing sector. "It's a very fragmented industry," he told the media. During a recent briefing on the impact of the pandemic on the global aviation industry. Even the combination of Gecas and Ireland's AerCap – the world's largest aircraft lessor by portfolio value, with a combined fleet of more than 2,000 aircraft and an additional 500 aircraft on order – does not represent a significant percentage of lessor supply. , he emphasized.

Kuwaiti Aircraft Leasing Major Secures $75m Financing Deal

"I think the leasing sector in general is competitive," Walsh said. “There are many, if not all, airline options. In fact, it would be fair to say that in many cases lessees were part of the solution to airlines' cash crunches until 2020, as you've seen a lot of sales and leasing activity. And in most cases, these are from my own experience [as a former CEO of an international airline group] at prices that I would consider normal or near normal. I'm not worried about the leasing industry at this stage."

According to Cirium, the proposed AerCap-Gecascombination would result in the combined fleet representing approximately 16 percent of the passenger aircraft leasing portfolio and 15 percent by value. With a tenant base of 266 airline customers, the combined entity will supply aircraft to more than a quarter of the world's airlines.

David Yu, professor of finance at New York University in Shanghai and chairman of Aviation Appraisal, an aviation consultancy in China and Asia, noted that "the leasing market is still not centralized and fragmented compared to other industries." The top 10 aviation skiers control a market share of less than 40 percent, while in other industries the concentration of the top 10 can reach 80 or even 90 percent.

Yu expects the aircraft leasing segment M&A activity to increase due to Covid. "In the last 10 years, the average of the top 10 tenants and the minimum size to enter the list have increased significantly, and the pandemic will accelerate this trend," he said, pointing to the need for most landlords to restructure them. Lease.

Ireland's Aircraft Leasing Industry

Readers favored cash-strapped airlines with lease concessions or short delivery delays. "One of the main reasons is that their banks have been very supportive of them," Yu said. "It's not about beauty; it's all about business... Who were they going to resell the mortgaged planes to?" That's why lessors and banks are reluctant to start repossessing the planes, he added. "But there's a catch." He warned that many portfolio restructuring deals were triggered and banks began to repossess aircraft from delinquent operators.

Alton Aviation Consultancy last year identified more than 900 passenger planes that were operated by "high risk" airlines - operators with two months or less of liquidity and no government ownership. They leased most of the 900 aircraft less than 10 years old. “The lessors supported the airlines with concessions; Now some need a structured plan to overcome the crisis on their own,” said Alton Consultants. They expect to see consolidation of the growing portfolio with the acquisition of well-capitalized tenants.

Commercial aircraft leasing companies, top 10 aircraft leasing companies, small aircraft leasing companies, aircraft leasing companies dublin, largest aircraft leasing companies, irish aircraft leasing companies, biggest aircraft leasing companies, aircraft leasing companies uk, top aircraft leasing companies, aircraft leasing companies ireland, aircraft engine leasing companies, listed aircraft leasing companies